Resources and Reports for CCOs

Creating "Insatiable Demand" - Handbook of Business Strategy 2004

By: Curtis N. Bingham, President of The Predictive Consulting Group, is the world’s foremost expert on Chief Customer Officers and is the Founder and Executive Director of the CCO Council, the only industry association for CCOs

Download this article as a PDF

Introduction

Umbrellas always sell well when it is raining. After a major hurricane hit Miami last year, Home Depot shipped in plywood from nearly every store in the southeast and still couldn’t keep up with the demand. Profiting by creating natural disasters is, of course, the stuff of comic books and spy novels but recognizing and satisfying unmet needs is the key tenet of the Demand Chain. When successfully leveraged, this focus on the Demand Chain (as opposed to the more commonly-observed Supply Chain) can enable a company to grow its revenue by creating “insatiable” demand, i.e. demand that significantly increases sustainable revenue, profit and loyalty from existing and new customers, while decreasing customer acquisition costs.

What is the “Demand Chain”? And how can we capitalize upon its promise of “insatiable demand?” There are many specific steps that can be taken to understand and implement Demand Chain practices which will be explored in this essay. Those who pay close attention to their Demand Chains will go on to achieve “Stage 5” of Demand Chain Excellence, and, once there, great and lasting business success.

What is the demand chain?

The Demand Chain is the overarching business philosophy that puts the customer at the center and focuses on developing long-term relationships with customers by proactively creating and delivering solutions that profitably meet continually evolving customer needs. Within the Demand Chain, the core focus is on involving customers and prospects in the delivery of products and services that customers want, need, and are willing to pay for - rather than strictly upon what the company has to offer.

Yet many companies believe that customers purchase as a result of effective advertising, fancy products, or even great customer service. In truth, while all of these may influence a customer purchase, none of these explain the primary reason for purchase. Customers purchase products, consume goods, or avail themselves of a service for one reason only: to make a problem go away!

Problems such as fear of ridicule or insecurity can be resolved with the purchase of a new suit or skincare products. A poorly performing sales force can be turned around through training or more drastic measures. Problematic vendors who deliver poor quality products provide ample incentives for a company to purchase from a competitor. In short, consumers, companies, and even nations buy to make problems go away.

Granted, some of these needs are more basic than others, and some needs may have even been fabricated (how many people need a $75,000 MontBlanc pen?), but the common principle is that purchases are made to make problems go away.

It takes time to make people want something. It takes even more money to convince people they have to have something. It is far easier and less expensive to find the NEEDS that already exist and satisfy them.

Companies managing their Supply Chain traditionally focus on optimizing their manufacturing and delivery process, sometimes to the exclusion of customer value. Companies focusing on the Demand Chain place the customer at the center and first determine the solutions that prospective customers need, then leverage the might of Supply Chain Management to deliver these solutions with the greatest efficiency and profits.

The Key Premise of the Demand Chain

While the mantra of “value creation” has been around for years, its meaning has been largely overlooked. Building value and differentiating services is not all about slick advertising, fancy packaging, and especially not about low price. Building value IS about understanding customers and delivering what THEY value.

To create insatiable demand, companies must build what customers need, want, and are willing to pay for.

This of course may seem commonsense but my own research has shown that the large majority of companies do not embrace this philosophy in practice. In this age of “customer demand,” companies can no longer afford to develop products and services based on supply-side economics, i.e. simply because they can. Gone are the days when companies could simply use marketing, advertising, and sales to create the demand for their products. No longer can companies afford to shell out millions of dollars for the purpose of creating the need for a product, especially because competitors today will often also benefit from these missionary efforts by saturating the market with lower-cost substitutes.

Even in companies professing to be “customer focused,” there is usually a huge gap between what companies think their customers want and what their customers actually do want, often because people internal to the company assume they are a representative sample of their customers and build flawed products based on their own experiences and interests.

Thus, to survive, companies must understand their customers and prospects better than anyone else - perhaps even their customers themselves - integrating their thoughts, attitudes, needs, and desires into everything they do as they proactively solve customer (and prospect) pain.

Why the demand chain is so important

Revenue and profitability are closely tied to effective Demand Chain Management. Revenues directly correlate with customer satisfaction, as has been scientifically shown by the ACSI/UMichigan Customer Satisfaction. In a 12-year study of more than 200 companies in 38 industries a direct correlation has been found between consumer satisfaction and revenue growth. The study shows that corporate revenues trail changes in consumer satisfaction by two or three quarters.

Furthermore, Wall Street rewards sales growth with a premium over growth by cost cutting. The Street recognizes growth in sales is more sustainable and therefore increases the expected future value of the company whereas growth by cost-cutting is a life-preserver scenario that imposes a finite limitation on profitability.

Most every product or service can be duplicated and in some industries even rendered obsolete within as few as six months. Product-based or service-based competitive differentiators are very hard to sustain.

The only sustainable competitive advantage is the in-depth understanding of customers - that nobody else should be able to duplicate.

Amazon.com for example hired away the bulk of Wal-Mart’s IT staff and in so doing stole Wal-Mart’s brain trust: logistics, inventory management, data warehousing, etc. Wal-Mart’s competitive advantage, while still strong, was diminished significantly. Amazon.com is now the clear winner in the online book sales business.

Between 40-60 percent of all new products fail and it is becoming increasingly costly to introduce new products. Most companies can’t afford these risks. The Demand Chain helps to decrease the uncertainty by ensuring that customers are involved early on to shape the development, delivery, and sales, ensuring success.

Customers today are becoming even more demanding than ever before. They increasingly expect individualized attention - immediately! In a recent Jupiter survey of online consumer expectations for help-desk response times of financial services companies, for example, it was found that 74 percent of respondents wanted email response from their brokers or other contacts within four hours maximum. The brokers, on the other hand, only promise 24-hour turnaround, sometimes not even delivering within that “long” a timeframe!

Comparing the demand chain with other hot topics

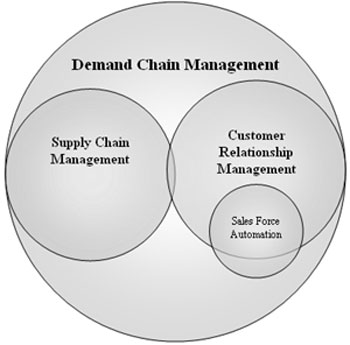

The principles of the Demand Chain are reminiscent of Customer Relationship Management and Supply Chain Management. And in fact, Demand Chain Management is a superset of both of these disciplines. Let’s take a look at how this is so.

Customer relationship mangement (CRM) & Sales Force Automation (SFA)

Although the notion of Customer Relationship Management implies enhanced, mutually beneficial relationships with customers (and prospects), the term CRM has been stained by software vendors to the point that CRM universally represents software. Most CRM approaches are still supply-based - they are used nearly exclusively to gather information so companies can sneak up on customers and sell them something. CRM strategies are primarily sales strategies, focusing on pushing existing products using cross-sell and upsell. A valuable, but secondary and often unused focus is that of customer retention. As such, CRM is not normally used to create new products to satisfy customer needs.

The Scope of Demand Chain Management

Sales Force Automation (SFA) is the precursor to and subset of today’s CRM practices, dealing primarily with contact management and the most basic of customer information gathering.

Supply chain management

Throughout the Supply Chain Management craze of the 80s and 90s, companies focused nearly exclusively upon increasing operational efficiency primarily through cost containment. During this time, companies have reduced costs by reducing waste, decreasing cycle times, outsourcing, etc. They have become exceptionally efficient in their manufacturing processes - and in some cases, have done so at the expense of their customers.

The Demand Chain focuses on growth potential through long-term customer relationships, revenue and market growth, and profit generation. With a Demand Chain focus, companies first identify what the “pain” is in the marketplace and then bring to bear all of their Supply Chain might to solve the market pain at the value-point that customers demand and in the most profitable manner.

Unfortunately the Supply Chain is limited by definition - there are only so many costs you can cut or processes you can optimize to achieve financial growth.

Thus, the larger picture of the Demand Chain and its attendant focus on solutions to specific customer pain helps bring focus and clarity to CRM and Supply Chain functions.

The 5 key stages of demand chain management

The 5 key stages of Demand Chain Management will be detailed along with characteristics of companies in each stage.

Companies at various stages of Demand Chain Management can be classified along three axes: the product and service drivers, their source of competitive advantage, and how proactively seek and use customer insight. Using these three axes, companies are categorized into five key stages ranging from Customer Disdain to Full Demand Chain Management. The stages are listed below, along with summaries of company characteristics along each axis.

Stage 0: Customer Disdain

Customers are viewed as unrealistic and demanding people who get in the way of interesting work:

- Product/Service Drivers: Engineering ideas based on “cool” technology.

- Competitive Advantage: Strictly technology-based.

- Customer Insight: Little understanding of customers - perhaps even disdain.

Stage 1: Customers as Path to Revenue

Company is enamored with what they think customers want. “This is how I would use it.” Only customer focus is to forecast revenue:

- Product/Service Drivers: Sales quotas and areas that engineering thinks customers want.

- Competitive Advantage: Technology-based, perhaps brute sales force

- Customer Insight: Used to drive sales forecasts.

Stage 2: Customers as Transactions

Customers are viewed as a series of transactions. They are “reactive” to customer complaints, i.e. “I know what customers want”...

- Product/Service Drivers: Modification requests, primarily from technical support, and sales quotas.

- Competitive Advantage: Product and technical support.

- Customer Insight: Account transactional history.

Stage 3: Customers as Niches

Customers are segmented, company can adapt to market conditions, customer focus extends throughout sales, service, marketing and sometimes engineering:

- Product/Service Drivers: Modification requests, services and marketing input.

- Competitive Advantage: Niche marketing, some operational excellence may emerge in product and service quality, particularly in niche plays.

- Customer Insight: Customer needs inferred through approximations of need such as demographics, firmagraphics, etc., customer data captured to increase sales and loyalty. Transactional data gathered in CRM system.

Stage 4: Customer Solutions According to Segment Needs

Companies make focused efforts to understand individual customer needs and use to develop certain products/services. Limited customer experience management via website:

- Product/Service Drivers: Some product lines are designed with specific customer input, product enhancements are often (but not always) made with customer input, adapting products to customers.

- Competitive Advantage: Marketing, useful products, support, website, companies beginning to work backwards from customers and use supply chain management to produce products customers want at profitable prices.

- Customer Insight: Leveraging advisory boards to gather input for modifications and enhancements and occasionally for new ideas. Some customer input coupled with CRM system provide minimal view of customers needs.

Stage 5: Full Demand Chain Management

- Product/Service Drivers: Customer pain drives all products and services.

- Competitive Advantage: The breadth and depth of the insight into customers’ needs, prospects wants, and marketplace changes, translated into business strategy.

- Customer Insight: Gathered at every touchpoint, made actionable, and disseminated throughout the organization.

Companies at various stages of Demand Chain Management can be classified along three axes: product and service drivers, their source of competitive advantage, and how proactively they seek and use customer insight.

The 5 Key Stages of Demand Chain Management

Stage 0: Customer Disdain

- Summary:

Customers are viewed as unrealistic and demanding people who get in the way of interesting work.

- Product/Service Drivers:

Engineering ideas based on “cool” technology.

- Competitive Advantage:

Strictly technology-based.

- Customer Insight:

Little understanding of customers–perhaps even disdain.

Stage 1: Customers as Path to Revenue

- Summary:

Company is enamored with what they think customers want. “This is how I would use it.” Only customer focus is to forecast revenue.

- Product/Service Drivers:

Sales quotas and areas that engineering thinks customers want.

- Competitive Advantage:

Technology-based, perhaps brute sales force.

- Customer Insight:

Used to drive sales forecasts.

Stage 2: Customers as Transactions

- Summary:

Customers are viewed as a series of transactions. Reactive to customer complaints. “I know what customers want.”

- Product/Service Drivers:

Modification requests, primarily from technical support, and sales quotas

- Competitive Advantage:

Product and technical support.

- Customer Insight:

Account transactional history.

Stage 3: Customers as Niches

- Summary:

Customers are segmented, company can adapt to market conditions, customer focus extends throughout sales, service, marketing and sometimes engineering.

- Product/Service Drivers:

Modification requests, services and marketing input.

- Competitive Advantage:

Niche marketing, some operational excellence may emerge in product and service quality, particularly in niche plays.

- Customer Insight:

Customer needs are inferred through approximations of need such as demographics, firmagraphics, etc. Customer data captured to increase sales and loyalty. Transactional data gathered in CRM system.

Stage 4: Customer Solutions According to Segment Needs

- Summary:

Companies make focused efforts to understand individual customer needs and use it to develop certain products/services. Limited customer experience management via website.

- Product/Service Drivers:

Some product lines are designed with specific customer input. Product enhancements are often (but not always) made with customer input. Adapting products to customers.

- Competitive Advantage:

Marketing, useful products, support, web site, companies beginning to work backwards from customers and use supply chain management to produce products customers want at profitable prices.

- Customer Insight:

Leveraging advisory boards to gather input for modifications and enhancements and occasionally for new ideas. Some customer input coupled with CRM system provide minimal view of customers’ needs.

Stage 5: Full Demand Chain Management

- Summary:

The End-All.

- Product/Service Drivers:

Customer pain drives all products and services.

- Competitive Advantage:

The breadth and depth of the insight into customers’ needs, prospects’ wants, and marketplace changes, translated into business strategy.

- Customer Insight:

Gathered at every touchpoint, made actionable, and disseminated throughout the organization.

Recommendations to reach full demand chain management

There are many actions that need to be undertaken in order to fully leverage the Demand Chain to create insatiable demand for products and services and most importantly to profitably satisfy customer needs. The following are the seven key actions that will deliver the greatest impact on your Demand Chain:

- Appoint an executive-level customer champion.

- Create a customer insight and experience group.

- Proactively uncover customer pain.

- Segment markets according to customer needs.

- Make customer data actionable.

- Involve customers in the design and development of products and services.

- Orchestrate the customer experience.

That for which there is no accountability cannot be changed. Thus, it is very important to create the sense of organizational and personal accountability for understanding and addressing customer needs. Even though many employees truly have the customers’ interests at heart, they do not have either the clarity of focus or the organizational clout to reach into divisional silos to effect change based on their customer insight.

There are two primary ways of establishing this accountability. The first is through appointing an executive level customer champion, and the second is through modifying the scope of traditional functional division focuses, most especially through creating a customer insight and advisory group.

Appoint an executive level customer champion

The first and most critical step to take in leveraging the Demand Chain is to appoint an executive-level customer champion responsible for maintaining a broad, comprehensive view of the customer, the market, and the company’s strategic direction.

Jeff Lewis, the former Chief Customer Officer of Monster.com, said, “A company’s value rests in its ability to meet the needs of its customers and prospects; therefore to be successful a company needs to hold accountable for this value a senior executive who can affect operations and strategy across operational silos.”

Research into dozens of companies who are implementing aspects of Demand Chain Management affirms this, indicating that without this executive-level customer champion, customer-centric data collection and change initiatives invariably fail.

This must be an executive level position so as to effect changes across multiple divisions in response to customer and market needs. The customer champion must leverage a customer intelligence process that proactively mines customers and the marketplace for information to provide a unified, objective view of customers, prospects, and the marketplace. With this breadth of information, the customer champion is qualified to serve as a customer advocate to company leadership and to the board of directors as well as an arbiter of customer priorities and strategic decisions. In addition, the customer champion must orchestrate the customer experience as well as act as a catalyst for cross-organizational change.

Create a customer insight and experience group

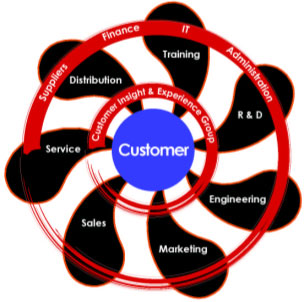

The hallmark of successful Demand Chain-oriented companies is their dedication to clearly understanding their customers’ pain and developing solutions to assuage this pain. To support this hallmark, companies must create a Customer Insight and Experience Group as the first step towards adopting the Demand Chain Organizational Model.

The hallmark of successful Demand Chain-oriented companies is their dedication to clearly understanding their customers’ pain and developing solutions to assuage this pain. To support this hallmark, companies must create a Customer Insight and Experience Group as the first step towards adopting the Demand Chain Organizational Model.

The model for an organization that effectively leverages its Demand Chain is based upon a fan wheel, with the customer as the hub and the business organizations forming the blades of the fan. Without the hub, a fan or propeller cannot function - much the same as a business cannot function without the customer and an in-depth understanding of their needs, wants, and desires. If a blade were missing on a fan or propeller, the whole system is out of balance and may even self-destruct; much the same as if a business unit was out of touch with the customers’ pain. This is altogether too frequently the case with R&D and/or Engineering as they develop products they view as “cool” or “challenging” instead of creating products that customers need and are willing to pay for.

The most critical of functions in this model is the Customer Insight and Experience Group.

To coordinate the various customer information needs, the Customer Insight and Experience Group works as a liaison between business units and customers. It is the “point contact” for the customers and is responsible for the gathering of customer insight and helping the business units translate this into the business-critical strategies. Customer interviews are scheduled through this group according to business rules put in place regarding which customers can be contacted, frequency of customer touches, outstanding or sensitive issues, etc. This means the group will:

- Be responsible for coordinating up-front efforts of everyone to lead customer/prospect analysis.

- Design the customer experience.

- Ensure consistent, mutually supportive messages across every available channel and every available format.

- Coordinate with marketing to segment markets and identify customers with the same needs as discovered during previous analyses of markets, customers, and prospects.

- Facilitate customer response teams.

- Oversee the customer experience and information gathering from all sources, including services, support, call centers and other channels.

This group may comprise people formerly from sales, marketing, product management, or customer service. The key requirement is the ability to maintain an impeccable relationship while gathering information and converting it into business strategy.

Proactively uncover customer pain

Opportunities to create insatiable demand and successfully retain existing customers go to those who are proactive in seeking out pain points in the marketplace. There are many different ways to uncover these unmet needs, from indirect methods such as industry research to first-hand methods such as focus groups and one-to-one interviews.

Generalized third-party research reports are valuable for obtaining a lowest-common denominator view of the marketplace, but they don’t offer the richness required to satisfy individual customer needs, and they definitely do not offer a competitive advantage because all competitors have the same information.

Surveys can provide slightly more rich information, but suffer from the fact that they also provide an aggregate, lowest-common-denominator view. Surveys do not lend themselves to exploration of underlying issues - by their very nature they are narrowly focused and closed-ended, eliciting a simple response, nothing more and nothing less.

The richest and most valuable data are obtained through direct contact with customers and prospects, as an experienced interviewer can not only obtain answers to specific questions but also uncover additional and sometimes more important pain points and issues and rapidly prioritize them.

MarketSoft Software Corporation had been told by venture capitalists that there was money to be made in the corporate training software market. As they spoke directly with experts in the field and potential clients, they found that while the pain was great, corporate training managers had no budget to make the purchase. In finding this out, they broadened their inquiry to ask C-level executives: “What is your greatest pain?” They found that because of poor or nonexistent lead management processes sales leads were going stale or even lost, resulting in lost revenue opportunities. Marketsoft was able to delve more deeply into the specifics of the pain and use this insight to create an extremely successful product, DemandMore Leads.

Greg Erman, the CEO of Marketsoft said: “The success of MarketSoft’s solutions is directly attributable to the up-front work we did to fully understand the pain our buyers felt. We’ve also worked very closely with our customers and others in the industry to make our products even better. In the end, we’ve beaten entrenched competitors because we’ve provided better solutions that more completely meet our customers’ needs.”

Customers provide an excellent insight into current demand - in other words, they will provide invaluable feedback on how incremental changes can be made to satisfy their needs.

However, the literature is littered with examples of failed companies that listened to their current customers alone. To accurately assess pending and future demand, prospects must be involved in the process as they are evaluating competitors’ offerings

Create a strategic plan to gather market insight and determine the most appropriate audience from whom to gather it. Identify the most valuable customers and prospects in each needs-based segment whom you believe feel the pain most acutely. Interview them using open-ended and probing questions to understand the breadth of the problem and involve them in identifying solutions.

Segment according to customer needs

Much has been written about different segmentation methods, the most common of which are demographics and firmagraphics for consumer and business customers, respectively. Each of these segmentation methods are poor substitutes for the real segmentation variable: customer needs. A security software company may believe that its customers are companies with more than 100 employees and $20M-plus in revenue. Using needs-based segmentation, the ideal customer may in fact be any company with extremely sensitive data and few controls to insulate itself from government audits. Reaching this accurately defined subset with this pain-based message is going to be far more profitable and may well reach companies not in the previous audience but still willing and able to pay for a solution.

Avery Dennison understood this when it segmented customers by their ability to sell large quantities of basic school and office supplies at approximately the same times. Avery organized cross-functional teams to intimately understand the needs of big-box office supply stores like Staples, Office Max, and Office Depot. The firm was so successful that it actually helped each store develop non-competing product promotion and placement strategies.

This form of segmentation is more difficult to achieve. But, if a prospect’s needs can be more clearly articulated and an intimate and accurate understanding of who will purchase and for what reasons can be developed, companies can simplify the marketing and sales processes as they increase revenue.

Make the data actionable

Perhaps the biggest challenge is making the customer data actionable. Fidelity Investments has created a very effective process to ensure the organization proactively and regularly gathers customer insight, makes it actionable, and drives change based on the highest priority customer issues. The results of this study are tied to recognition and compensation.

Within this model, the Customer Champion conducts bi-annual customer surveys to uncover customer dissatisfiers. An executive review team prioritizes issues and assigns cross-functional teams to learn more about the specific customer pain and find solutions in partnership with customers. The timely and effective resolution of these dissatisfiers is tied to compensation and recognition.

Customer data must be converted to insight and finally into action. Without this step, there can be no significant improvement.

INVOLVE BEST CUSTOMERS & PROSPECTS IN THE DESIGN AND DEVELOPMENT OF PRODUCTS AND SERVICES

In its earlier years, EMC brought in its best customers during its 18-month product development cycle and worked very closely with them to design and develop its flagship enterprise storage solutions that exactly matched customer needs. In so doing, they significantly increased the certainty of product success in the marketplace.

The keystone of the Demand Chain model is the involvement of the most valuable customers and especially prospects from each needs-based segment in the design and development of products and services. For many customers and prospects, the promise of finding a complete and total solution to most onerous needs is sufficient incentive to participate in this process.

ORCHESTRATE THE CUSTOMER EXPERIENCE FROM START TO FINISH AND ACROSS ALL TOUCHPOINTS

Customers do not think about touchpoints or channels in communicating with a company. Their only concern is resolving a problem. Customers want the experience to be the same no matter how they reach the company. If one communications channel such as a website or interactive voice response (IVR) system is painful to use, the whole effort to create long-lasting, profitable customer relationships can be destroyed.

Design the customer experience throughout all channels as part of the new product design, implementation, and release strategy. Use the in-depth understanding of the customer’s needs to guide the type of information made available, the actions allowed, etc. Each customer touchpoint must deliver the same, compelling messages regarding the solutions to customer pain.

Conclusion: "There" is not enough

Sir Edmund Hillary climbed Mount Everest “because it was there.” But no longer can companies afford to build products “because they can” or simply because customers are “there.”

Through the executive-level customer champion and the customer insight and experience group, companies can proactively uncover customer pain and drive change throughout the organization as well as hold the organization accountable for understanding and addressing customer needs. Needs-based segmentation provides the organization with the critical focus on solving specific needs, enables the better allocation of resources on solutions that will have the greatest return, and helps marketing and sales be far more effective in reaching qualified prospects and customers.

To continually create insatiable demand resulting in significantly increased revenues, companies must reach Stage 5 of Demand Chain Management wherein customer pain is the primary driver of the creation and delivery of all products and services. Companies must create as their core competitive advantage the breadth and depth of insight into customers’ needs, prospect wants, and marketplace changes, translated into business strategy. To survive in these impossible times and to maintain leadership in good times and bad, companies must thoroughly understand their customers’ needs and continually satisfy them better than anyone else around. In this way, they will leverage their Demand Chains, make customers loyal and happy, and stay on top.

Customers purchase products, consume goods, or avail themselves of a service for one reason only: to make a problem go away!

It takes time to make people want something. It takes even more money to convince people they have to have something.

Most every product or service can be duplicated and in some industries even rendered obsolete within as few as six months.

Between 40-60 percent of all new products fail, and it is becoming increasingly costly to introduce new products. Most companies can’t afford these risks.

To survive, companies must understand their customers and prospects better than anyone else—perhaps even their customers’ themselves—and integrate their thoughts, attitudes, needs, and desires into everything they do as they proactively solve customer (and prospect) pain.

The first and most critical step to take in leveraging the Demand Chain is to appoint an executive-level customer champion.